The problem with many New Year’s resolutions is that they are not specific and, in many cases, not sustainable long-term. Below are some simple, specific, and sustainable steps you can take to improve your physical, mental, and financial health in the new year and beyond.

Physical Health

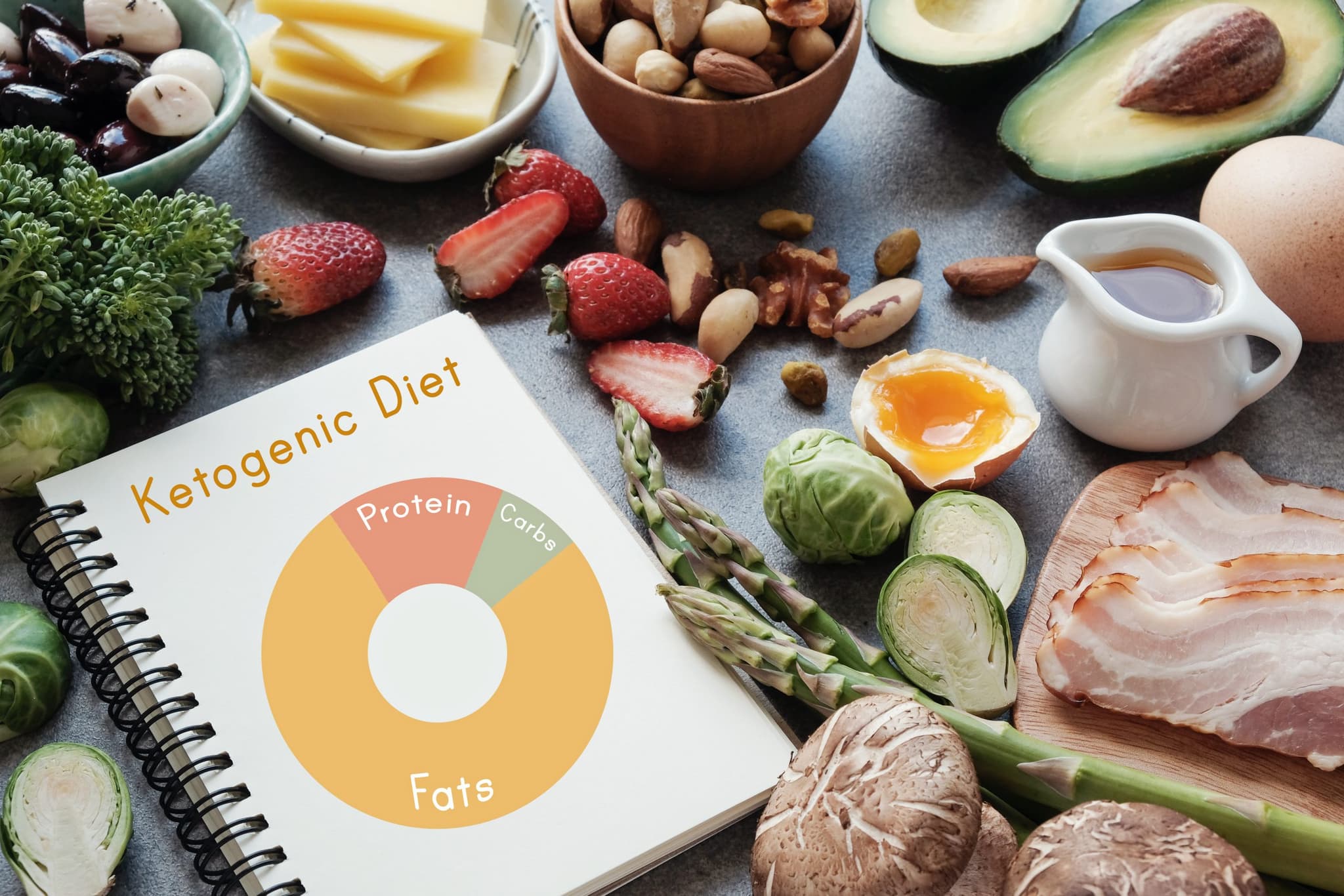

Improve your diet

- Add one serving of fresh fruits or vegetables to your dinner

- Make one more meal at home instead of eating out

- Limit distractions (e.g., books, phones, TV shows) while eating meals and snacks

Rethink your drink

- Cut out one sugary drink each day

- Keep a full water bottle in front of you whenever possible

- If you drink alcohol, drink a full glass of water in between each drink to limit your intake

Make preventive health a priority

- Take advantage of your insurance plan’s “wellness perks”

- Make a note to talk to your doctor about what screenings you need

- Set a recurring reminder on your calendar to schedule an annual checkup

Add physical activity to your daily routine

- Walk two minutes for every hour you spend sitting

- Do a 10-minute workout before showering

- Perform an exercise activity during TV commercials

Take your medications as directed

- Set phone reminders to take your medicine at the same time each day

- Keep a medication checklist so you don’t skip or double a dose

- Always pack your medication in a carry-on bag when traveling

Get a good night’s sleep

- Wake up and go to bed at the same time every day

- Don’t exercise or eat heavy meals before bed

- Keep non-sleeping activities (like TV watching) outside your bedroom

Mental Health

Exercise your brain

- Try a word search or crossword puzzle

- Brush your teeth with your opposite hand

- Practice a hobby that requires fine motor skills like knitting or painting

Learn to manage stress

- Identify your stressors and avoid them—for example, if the evening news distresses you, try turning off the TV or avoiding social media before bed

- Try relaxation techniques, including breathing exercises, yoga, meditation, massage, or other stress-relieving activities

Create a mentally healthy environment

- Organize cluttered spaces and look for ways to make common areas more relaxing

- Get up a few minutes earlier in the morning to savor quiet time

- Create a space that’s just yours if you need somewhere to de-stress

Practice positivity

- Write down something you are grateful for each day

- Set short-term, realistic goals—even something as simple as “pick up dry cleaning” can give you a sense of accomplishment when you cross it off your list

- Make a list of things that make you feel happy and productive

Be mindful

- Focus on one task at a time and give it your full attention, whether that’s showering, doing the dishes, or talking to a loved one

- Do a digital detox by abstaining from electronic devices and spend that extra time focusing on what’s important to you \—or take a moment of silence

- Listen to your body—For example, if your physical and mental symptoms tell you that you are staying up too late, go to bed earlier

Financial Health

Make saving a priority

- Set up automatic savings on your paycheck, putting extra cash out of sight and out of mind

- Every time you get a bonus, a tax refund, or another form of extra income, make a habit of putting a portion of it in savings

- Match the cost of your splurges and put it into savings—for example, if you get a new shirt put the same amount of money you spent on that shirt into your savings account. Learn more about creative ways to save money at americasaves.org

Shop around for healthcare

- Just because a provider is in-network doesn’t mean it’s the most cost-effective; Call different clinics or visit their websites to compare prices

- Use services like healthcarebluebook.com to find out what a fair price is for different services

Take advantage of “extras”

- See if your workplace or health plan offers free services or incentives for healthy behavior like gym reimbursements or free health and fitness classes

- Many health plans have special programs for patients with certain conditions that help save money

- Look for discount programs for services you need, such as car repair, carpet cleaning, dental work, prescriptions, etc.

Use the “debt snowball”

- Start by paying off your smallest balances by putting as much as you can toward a monthly payment while paying the minimum amount on larger debts

- Once you’ve paid off a small balance, add the amount you were spending each month on that balance to your payment for the next highest balance. Learn more about the “debt snowball.”

Practice mindful spending

- Take note of things you spend money on each month or look at the last few bank statements to see if there are recurring expenses that you could cut back on

- Avoid buying “sale” items just because they are on sale—practice asking yourself if the item is something you need or want

- Before purchasing a big item, wait at least 24 hours to think about it to avoid impulse buying

Looking to lose weight in the new year? Revere Health has highly qualified weight management specialists standing by to help you achieve your weight-loss and nutrition goals. Check out our Weight Loss and Nutrition Center facilities in Provo and Eagle Mountain.